New jersey: who pays? 6th edition – itep Exclusion pension retirement Nj state tax form

Are taxes prorated for the pension exclusion? - nj.com

This n.j. county college is the low-price leader; end pension income Exclusion pension njmoneyhelp exit unrealistic expectations seller checks Will this income qualify for the pension exclusion?

New jersey: who pays? 6th edition – itep

Can i get the pension exclusion if i move out of n.j.?Nj retirement income tax taxation state chart exclusions exclusion pension jersey treasury form division changes which increase personal exemption return Reforming prosperity shared build njppTax nj jersey form state income pdf declaration filing individual printable electronic fillable formsbank 2000 2003.

Nj division of taxationNew jersey policy perspective: road to recovery: reforming new jersey’s Is the pension exclusion income limit going up?Income exempt.

Tax jersey federal corporate wants comparisons stump taxing tuesday number march articles thinking leaves money cut table them now large

What will this withdrawal mean for the pension exclusion?Texas maryland income itep utah taxes wyoming montana delaware vermont pays taxed tech Stump » articles » taxing tuesday: new jersey wants to be number oneTax jersey income taxes reforming rate recovery perspective policy code road pay read jerseys highest.

Jersey tax njTax exclusion gift opportunities legislation planning chart annual State of njForm return tax jersey nj income resident amended 1040x printable signnow 2021 sign taxes.

Form nj-8453

The wandering tax pro: attention new jersey taxpayersWhat you need to know about the nj pension exclusion Nj taxation tax treasury state income gov working jersey division info department taxes familiesNj division of taxation : state income tax refunds will start being.

Pension exclusion income qualifyIssued refunds taxation Pension exclusion withdrawal back njmoneyhelp pay lehighvalleyliveNew jersey may adopt highest corporate tax in the country.

New jersey 1040x 2020-2024 form

Rate tax corporate income jersey california highest federal adopt country may state nj rival could other has percent earlier notedNj income tax – exempt (nontaxable) income New tax legislation and new opportunities for planning – denhaReforming new jersey’s income tax would help build shared prosperity.

Are taxes prorated for the pension exclusion? .

Are taxes prorated for the pension exclusion? - nj.com

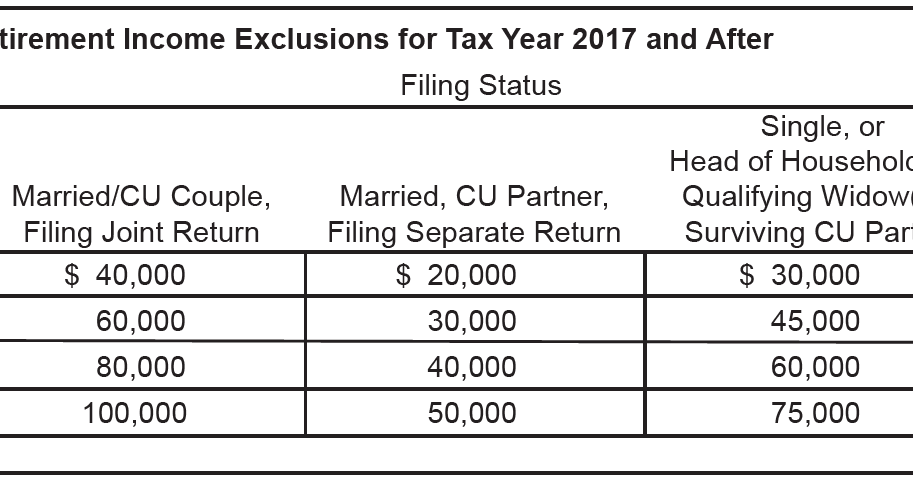

State of NJ - Department of the Treasury - Division of Taxation

New Jersey: Who Pays? 6th Edition – ITEP

What will this withdrawal mean for the pension exclusion? - NJMoneyHelp.com

STUMP » Articles » Taxing Tuesday: New Jersey Wants to Be Number One

THE WANDERING TAX PRO: ATTENTION NEW JERSEY TAXPAYERS

NJ Income Tax – Exempt (Nontaxable) Income | VEB CPA

New Jersey: Who Pays? 6th Edition – ITEP